Start Investing with Confidence, Even If You’re Brand New

This free bootcamp is your first step toward confident investing. In just a few short lessons, you’ll learn a simple system you can actually use.

Most church leaders feel overwhelmed by money and unsure where to even start.

This bootcamp gives beginners a safe, step-by-step way to invest without jargon or complexity.

Imagine the peace of finally knowing how to grow your savings with confidence and consistency.

What You’ll Learn

How stocks actually work and why you don’t need Wall Street experience to invest.

How to open your first brokerage account with step-by-step instructions.

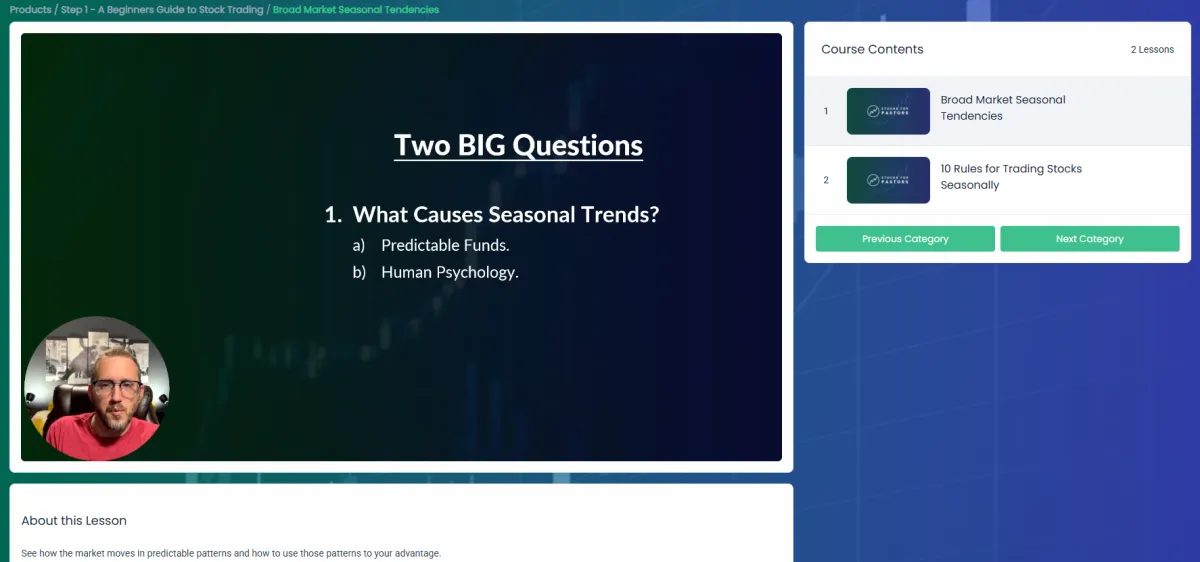

What seasonal investing is and why it gives beginners a unique edge.

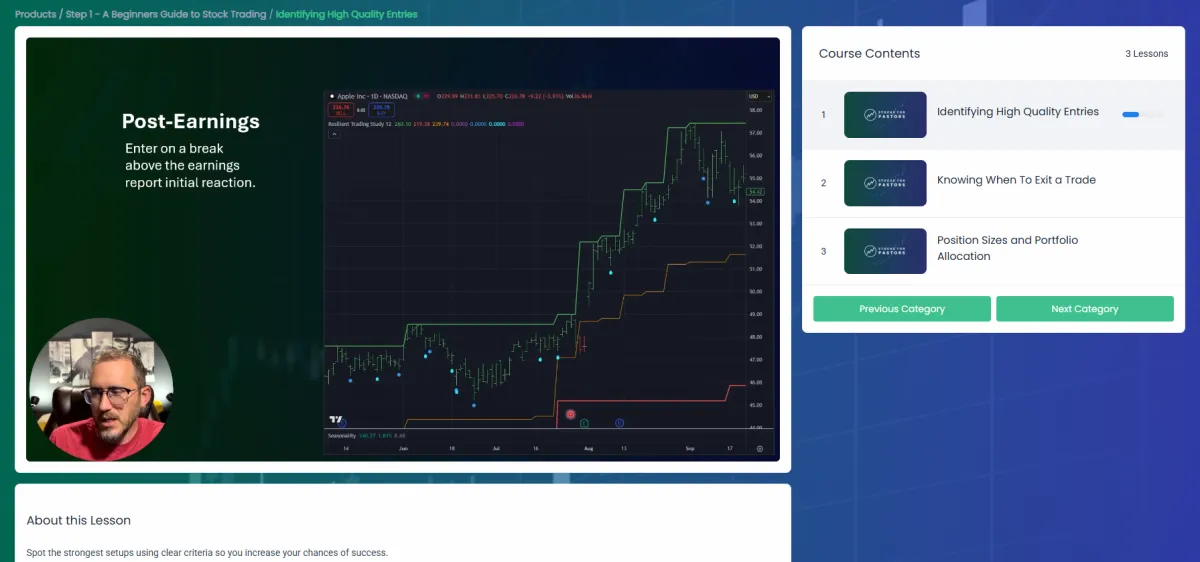

A simple trading system that helps you decide when to buy and sell.

First steps for new investors so you can start with confidence, not confusion.

Why Seasonal Investing Works

Seasonal investing is built on predictable, recurring patterns in the market. Think of it like planting in the right season: some months are better for certain stocks than others. By learning these patterns, you can make informed trades that reduce guesswork and increase confidence.

This training walks you through the process step by step, so you can take advantage of these patterns without spending hours in front of charts.

This Bootcamp was built for busy leaders who don’t want another endless online course. It’s short, focused, and designed to get you moving right away.

Who This Is For?

The First-Time Investor

You’ve never bought a stock in your life, and you want someone to walk you through the basics without making you feel dumb.The Frustrated Dabbler

You’ve bought stocks here and there, maybe even followed tips or trends, but you’ve never seen consistent results. You’re ready for a proven system that actually works over time.The Overwhelmed Saver

You’ve tried saving, but it feels slow and discouraging. You want a way to actually grow your money instead of watching it sit there.The Busy Leader

You don’t have hours each week to watch charts or read financial reports. You need a simple plan that fits into your real schedule.

I've been a pastor for over 25 years and an investing coach for more than 15. My mission is to help leaders like you build financial resilience so you can focus on your calling.

"I don’t believe in get-rich-quick schemes. This course teaches the same steady approach I’ve used for years to help leaders grow their savings without stress."

This is the system you’ll learn in the Bootcamp. I've been trading it personally for years and have teaching it to leaders like you since 2018.

Average 2–3% ROI per month for the past 7 years

Turned $1,000 into $5,000 in 2 years using this exact system

Repeatable trades built on seasonal patterns with a high win rate

Here’s what other leaders who started right where you are Have to Say about their experience with Stocks for Pastors.

“I never thought investing was something I could do, but this gave me confidence, clarity, and a clear path forward.”

Joel S.

“My account has nearly doubled in 18 months since I started with Stocks for Pastors.”

Eric B.

“Michael’s course has helped me see a clear path to advance my family financially. It is doable and attainable- exactly like he said it would be."

Dave C.

Everything You Need, Right Here

This Bootcamp is not a teaser or a sales pitch. It’s a complete, beginner-friendly system you can use to start investing with confidence. You don’t need to buy anything else to make this work.

In just a few short trainings, you’ll know how to open your account, spot seasonal opportunities, and place your first trade with a proven process.

No fluff. No missing pieces. Just a clear path you can follow starting today.

Read Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

How the Government Shutdown Affects the Stock Market

We woke up to a real shutdown on October 1, 2025. Congress failed to extend funding by the midnight deadline, so non-essential federal operations have paused. Headlines are loud, but traders need signal, not noise. Here is what matters for markets and how to adjust your plan this week.

First, the facts:

The federal government shut down at 12:01 a.m. ET on October 1 after the Senate failed to advance competing funding bills. This is the first shutdown since 2018-2019.

The White House Council of Economic Advisers projects a hit of roughly 15 billion dollars to GDP for each week the shutdown lasts, with tens of thousands of potential job losses if it runs a month. Expect spillovers to consumer spending and travel delays if unpaid federal workers stay home.

Equity markets did not panic on Day 1. The S&P 500 and Dow finished higher, with fresh record closes even as the shutdown began. Gold rose and the dollar slipped.

A key market complication is data. With a shutdown, many government economic reports pause, including payrolls and weekly jobless claims, leaving the Fed and investors flying with fewer instruments on the dashboard.

The SEC has a contingency plan for a lapse in appropriations. Expect “extremely limited” operations and delays in reviews of registration statements, which can affect IPOs and certain corporate actions until normal staffing resumes.

What history says about shutdowns and stocks

Shutdowns are disruptive for workers and services, yet the market impact is usually modest if the closure is brief. Studies and strategist commentary show most shutdowns have had limited, short-lived effects on the S&P 500. Investors often look through the noise, especially when earnings and liquidity remain supportive.

Translation for your playbook: a shutdown is not a macro regime shift by itself. Duration is the driver. A few days to a couple of weeks tends to be a headline risk. A long standoff can nick growth and confidence at the margin.

What changes for traders right now

Less data creates more uncertainty. If agencies like the Bureau of Labor Statistics stop putting out reports like jobs numbers or inflation data, traders lose some of their main guides. Private reports like ADP or PMI might move the market more, but they are not perfect substitutes. With less clear information, traders should use smaller trade sizes to manage risk.

Concerns about government stability. Credit rating agencies and analysts are already warning that a long shutdown makes the U.S. look less reliable. That usually doesn’t crash the market, but it can make investors more cautious and push risk a little higher.

Slowdown in new deals. With the SEC operating at limited capacity, things like IPOs or other filings that need staff review can get delayed. This means some companies may have to wait to raise money until the shutdown ends.

Sector effects. Industries that rely heavily on federal money—like defense contractors or healthcare groups—might see more pressure. Companies that depend on timely payments could face issues if money is delayed. On the other hand, big tech stocks often move more on their own earnings and trends, so they may stay strong even during a shutdown.

Safe-haven moves. On the first day, gold went up while the U.S. dollar went down. If the shutdown continues, this pattern may keep showing up. It is less about a trading signal and more a sign that investors are nervous.

A simple framework for the days ahead

Use this checklist to keep decisions clean and sized appropriately:

Filter harder. Only trade A-quality setups that already fit your rules. In uncertainty, quality control is your edge. Historical evidence supports staying selective.

Right-size risk. Cut position size 25 to 50 percent when the normal macro data backdrop goes dark. This is not fear, it is math under higher variance.

Expect bigger reactions to shutdown headlines. Be prepared for sharp moves when news drops about the shutdown. These swings could go in either direction, so manage your size and wait for confirmation before acting.

When to change your stance

If the shutdown stretches and consumer or business confidence cracks, the growth path dents and markets start to price it. The White House baseline loss math is 15 billion dollars of GDP per week, which compounds if the impasse lingers. Should that scenario develop alongside a soft labor trend, expect volatility to widen and cyclicals to lag until a funding deal emerges.

Bottom line

Day 1 confirmed what history suggests. Markets can rally through a shutdown, especially when earnings leadership and liquidity are intact. A shutdown is the result of idyological standoffs... aka government disfunction. And truthfully, the market is used to government disfunction so it takes the current political landscape with a grain of salt.

The risk is not the headline itself, it is the duration and the collateral damage from missing data and delayed agency functions. Trade your plan, shrink size in the fog, and let quality do the lifting. When Congress funds the government again, the data calendar resumes and risk can be re-scaled.