Start Investing with Confidence, Even If You’re Brand New

This free bootcamp is your first step toward confident investing. In just a few short lessons, you’ll learn a simple system you can actually use.

Most church leaders feel overwhelmed by money and unsure where to even start.

This bootcamp gives beginners a safe, step-by-step way to invest without jargon or complexity.

Imagine the peace of finally knowing how to grow your savings with confidence and consistency.

What You’ll Learn

How stocks actually work and why you don’t need Wall Street experience to invest.

How to open your first brokerage account with step-by-step instructions.

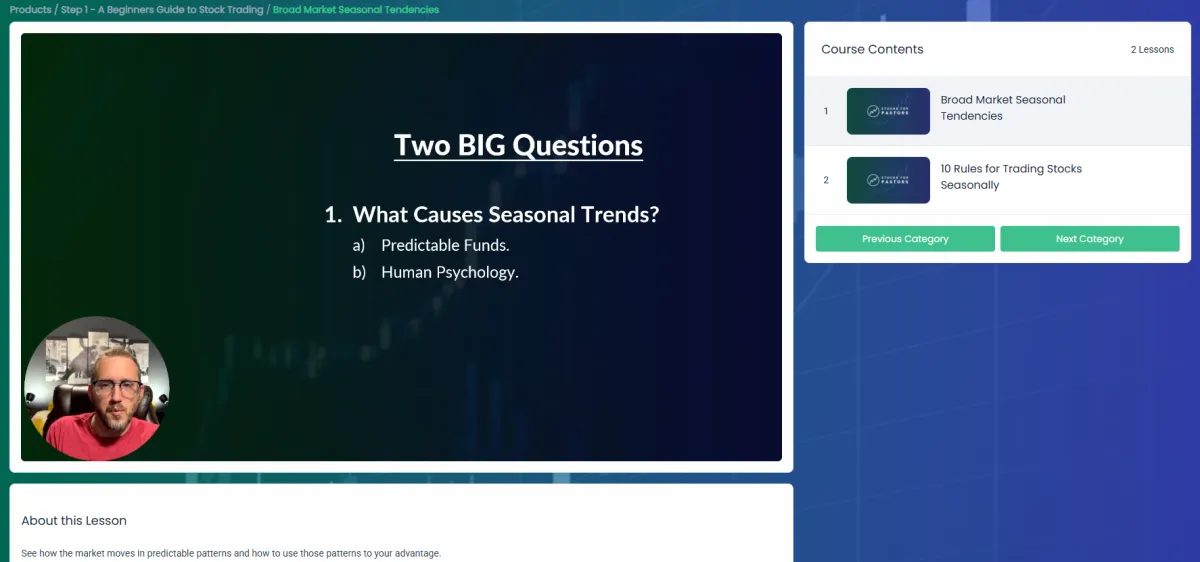

What seasonal investing is and why it gives beginners a unique edge.

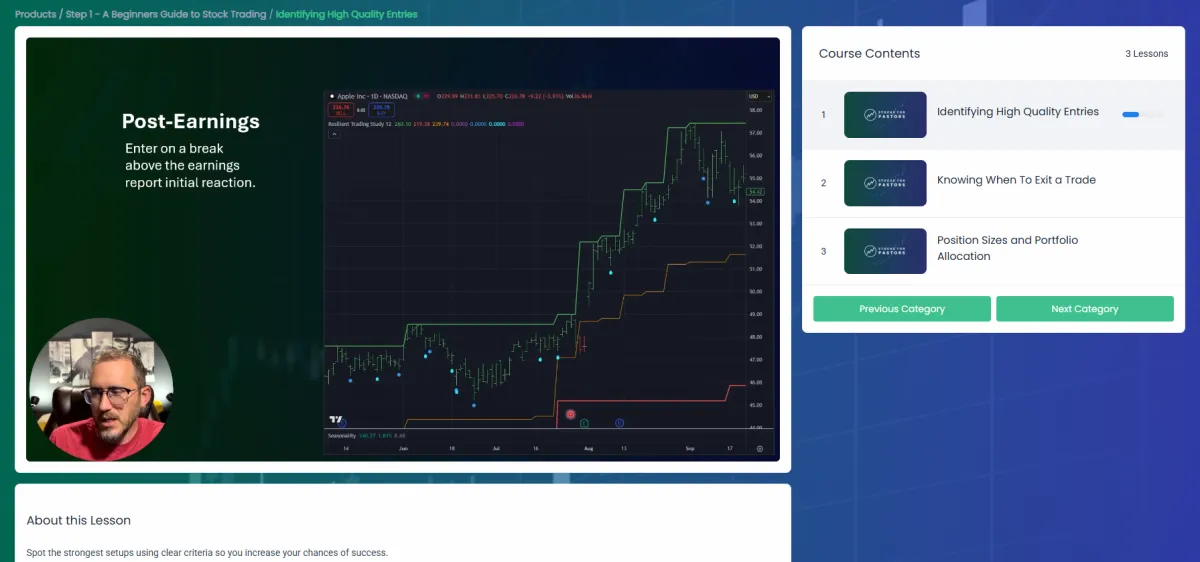

A simple trading system that helps you decide when to buy and sell.

First steps for new investors so you can start with confidence, not confusion.

Why Seasonal Investing Works

Seasonal investing is built on predictable, recurring patterns in the market. Think of it like planting in the right season: some months are better for certain stocks than others. By learning these patterns, you can make informed trades that reduce guesswork and increase confidence.

This training walks you through the process step by step, so you can take advantage of these patterns without spending hours in front of charts.

This Bootcamp was built for busy leaders who don’t want another endless online course. It’s short, focused, and designed to get you moving right away.

Who This Is For?

The First-Time Investor

You’ve never bought a stock in your life, and you want someone to walk you through the basics without making you feel dumb.The Frustrated Dabbler

You’ve bought stocks here and there, maybe even followed tips or trends, but you’ve never seen consistent results. You’re ready for a proven system that actually works over time.The Overwhelmed Saver

You’ve tried saving, but it feels slow and discouraging. You want a way to actually grow your money instead of watching it sit there.The Busy Leader

You don’t have hours each week to watch charts or read financial reports. You need a simple plan that fits into your real schedule.

I've been a pastor for over 25 years and an investing coach for more than 15. My mission is to help leaders like you build financial resilience so you can focus on your calling.

"I don’t believe in get-rich-quick schemes. This course teaches the same steady approach I’ve used for years to help leaders grow their savings without stress."

This is the system you’ll learn in the Bootcamp. I've been trading it personally for years and have teaching it to leaders like you since 2018.

Average 2–3% ROI per month for the past 7 years

Turned $1,000 into $5,000 in 2 years using this exact system

Repeatable trades built on seasonal patterns with a high win rate

Here’s what other leaders who started right where you are Have to Say about their experience with Stocks for Pastors.

“I never thought investing was something I could do, but this gave me confidence, clarity, and a clear path forward.”

Joel S.

“My account has nearly doubled in 18 months since I started with Stocks for Pastors.”

Eric B.

“Michael’s course has helped me see a clear path to advance my family financially. It is doable and attainable- exactly like he said it would be."

Dave C.

Everything You Need, Right Here

This Bootcamp is not a teaser or a sales pitch. It’s a complete, beginner-friendly system you can use to start investing with confidence. You don’t need to buy anything else to make this work.

In just a few short trainings, you’ll know how to open your account, spot seasonal opportunities, and place your first trade with a proven process.

No fluff. No missing pieces. Just a clear path you can follow starting today.

Read Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Why You Need a Pre-Defined Stop (and How to Set It)

Most traders focus on entries and targets but ignore the middle, the place where risk lives. That’s a mistake. Not having a pre-defined stop is gambling, not trading. A stop is not just a safety net; it’s part of your strategy. It protects your capital, your mindset, and your ability to stay in the game long enough to grow. When you plan a trade, think of the stop as the anchor that keeps your strategy grounded. It defines your maximum acceptable loss before emotion can take over and helps ensure you can trade again tomorrow even if this position fails. Over time, this discipline compounds by protecting your account from ruin, sharpening your analysis, and freeing mental bandwidth so you can focus on execution instead of survival.

Why Stops Matter

The best traders in the world think about risk before reward. They know that if you can’t define your downside, your upside doesn’t matter. Every trade carries uncertainty, no matter how good the setup looks. A stop-loss defines where you are wrong and limits how much you can lose when that happens. Without it, small mistakes can turn into major drawdowns. Experienced traders also understand that stops give them more freedom, not less, because they remove the fear of being trapped in an uncontrolled move. Knowing your stop is in place lets you commit fully to the trade without hesitation, allowing better focus on execution and follow-through.

Stops also protect your emotional capital. Once you set it, the decision is made. You don’t have to second-guess or panic when price moves against you. It removes stress and lets you trade your plan instead of your emotions. This emotional discipline compounds over time, building the kind of calm consistency that separates professional traders from those constantly reacting to every tick. When your stop is planned and respected, your decisions improve, your learning accelerates, and your confidence grows with each well-managed trade.

Where Most Traders Go Wrong

New traders often set stops based on how much money they feel comfortable losing instead of where the market structure says the trade is wrong. Others avoid stops altogether, hoping price will turn around. That approach might work once or twice, but over time it guarantees ruin. The market doesn’t reward hope; it rewards discipline. To trade professionally, you have to think in probabilities and structure, not feelings. The stop must be where your original trade idea is no longer valid, where market action proves you wrong, not just where you feel discomfort. Setting stops this way turns losses into useful feedback instead of emotional pain, because each one reinforces that your system is working as designed.

Another mistake is setting stops too tight. If your stop is inside the normal noise of price movement, you’ll get shaken out even when your setup is valid. Instead of allowing the trade space to play out, you end up donating small losses repeatedly, mistaking volatility for invalidation. A properly placed stop considers volatility, structure, and time frame. The goal is not to avoid every small loss. It is to stay alive for the big wins that follow the plan and to give your setups the room they need to unfold naturally without emotional interference.

How I Set My Stops

I start with structure. Every chart tells a story, and the stop belongs at the point where that story breaks.

Swing highs and lows: For bullish trades, my stop goes just below the most recent swing low. For bearish trades, just above the swing high.

VWAP and key levels: I use anchored VWAP to identify zones where institutions are likely defending positions. If price breaks that level, it’s a sign that control has shifted.

ATR multiples: I use the Average True Range to account for volatility. A stop one to one and a half times the ATR away from entry gives the trade room to breathe without being reckless.

Before I enter, I calculate position size so the dollar risk of that stop fits within my rules, usually no more than one percent of account equity per trade. That way, I can take multiple trades and still sleep well at night.

How to Avoid Being Shaken Out Early

Even the best stop can fail if you manage it emotionally. The key is to trust your placement. Don’t move it tighter just because the trade is taking longer than expected or because you feel nervous watching small fluctuations. Give the setup time to breathe, and remember that the stop was chosen for a reason. Only adjust your stop when the market gives you a technical reason such as a new swing point forming, a clear shift in structure, or volatility expanding in a way that changes the chart’s story. This approach requires patience and faith in your preparation.

Trailing stops can help protect gains once a trade moves in your favor, but they should follow logic, not fear. For example, I might trail under higher lows in an uptrend or behind VWAP as price extends. As momentum builds, I sometimes widen the trail slightly to avoid premature exits, allowing the trend to mature while still keeping profits protected. A thoughtful trailing stop should move strategically with the market’s rhythm rather than reacting emotionally to every uptick or downtick.

The Mindset Behind Good Stops

Stops are not about fear; they are about control. You can’t control what the market does, but you can control how much you lose. Every great trader accepts small losses as part of the game. What they don’t accept is losing discipline. If you treat every trade as a lesson in risk management, consistency follows.

Final Word

Trading without a stop is like driving without brakes. You might be fine for a while, but eventually something unexpected will happen. The traders who last are the ones who define their exits before they enter. Set your stops based on structure, not emotion, and you’ll turn uncertainty into strategy. If you want to learn how to apply these risk rules in your own trades, join the free bootcamp where I teach practical methods for setting stops, managing risk, and building consistency in every market condition.