Go beyond the basics with advanced strategies, hands-on coaching, and the ongoing support you need to trade like a pro.

Multiply Your Trading Skills and Grow Your Monthly Income Faster

You Don’t Need Another Job. You Need a Paycheck That Works on Your Terms.

You’ve probably heard it before:

“Start a side hustle.”

“Pick up some extra speaking gigs.”

“Drive for Uber in your free time.”

But deep down, you know the truth: Your time is already maxed out.

What you need is margin. Not more hustle.

What If You Could Run a Simple, Part-Time Trading Business From Your Laptop?

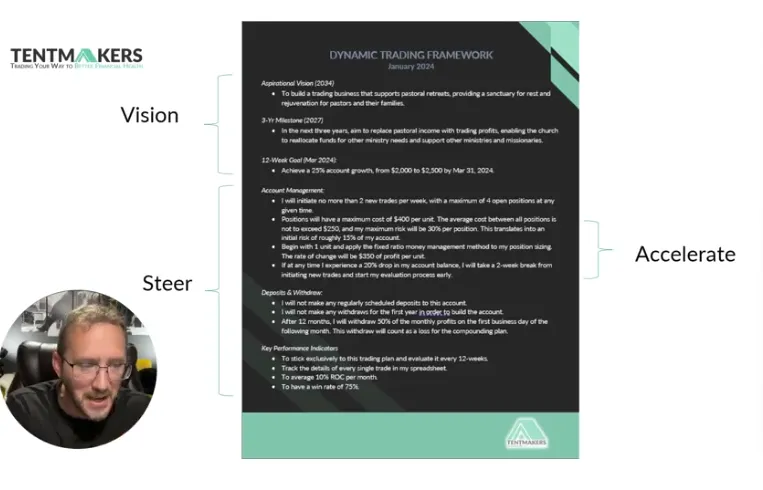

The Income Accelerator is a complete system designed to help entrepreneurial-minded pastors create withdrawable income every month using options trading.

It’s not a hobby. It’s not guesswork.

It’s a repeatable process to build a lean, flexible business that pays like a second job, without pulling you away from your first calling.

You’ll know exactly what to do, when to do it, and how to manage it.

How It Works

This isn’t “set it and forget it” investing. This is business building, with tools, structure, and strategy.

All Four Strategies: Seasonal Leverage Method, CFC, DCS, and our bonus 4th starter strategy.

Weekly Trade Alerts: Follow along with exact setups for every strategy.

Monthly Group Coaching: Live calls to review trades, sharpen your skills, and get your questions answered in real time.

Unlimited Email Support: Direct answers when you need them so you’re never trading alone.

Private Coaching Channel: Advanced trade reviews and deeper discussions with other Accelerator members.

What's Included

When you join the Income Accelerator, you get full access to:

The Options Business Course:

Learn the full framework behind this income-generating model. Taught in clear, practical lessons.

All Four Trading Strategies:

Master the complete playbook, from beginner-friendly methods to advanced setups, so you can adapt to any market condition.

Real-Time Trade Alerts:

Follow Michael’s actual trades each week. Know what to trade, when, and why.

Monthly Group Coaching Calls:

Get feedback, troubleshoot your trades, and grow with a like-minded community.

Unlimited Email Support:

Run your trading like a system, not a guessing game.

Supportive Private Group:

Be part of a network of pastors and ministry leaders building the same kind of freedom you are.

Real Results. Real Income.

This isn’t theory. These are actual results.

Since launching the Income Plan in April 2023, Michael has placed 221 trades with a 79.6% win rate, using the same strategy shared in this program.

Started the portfolio in April 2023 with a $2,000 account.

Earned $11,437 in profit over 24 months!

Average Monthly ROI: 5.9%!

Average Monthly Income: $477!

Only 2 Losing Months: 91.7% winning months!

That’s not flashy day trading. That’s consistent, repeatable income—built with focus, discipline, and a strategy that works.

If a $2,000 account can generate nearly $12K in profit in two years, imagine what this could mean for your family, your ministry, or your financial peace of mind.

While results are never guaranteed and losses are always possible, many Accelerator members report profit potential in the $500–$700/month range as they gain confidence and consistency with all four strategies.

PRICING

Choose Your Plan

Foundations

$97/mo

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for SLM and MIS strategies

Access to member community

Downloadable checklists, templates, and guides

Up to 3 questions per month, responses within 48 hours

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective Course

Double Canopy Strategy Course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

Income Accelerator

$197/mo

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for all four strategies

Access to member community

Downloadable checklists, templates, and guides

Unlimited questions, priority same-day response

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective course

Double Canopy Strategy course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

Get 2 Mo FREE

$1,970/yr

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for all four strategies

Access to member community

Downloadable checklists, templates, and guides

Unlimited questions, priority same-day response

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective course

Double Canopy Strategy course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

For Pastors Who Think Like Entrepreneurs

Wants to provide more for your family without overextending your time

Believes financial margin creates ministry freedom

Is ready to treat income generation with the same intentionality as discipleship

Doesn’t want hype, just a method that works

Is willing to learn, apply, and grow

You're not just looking to invest.

You're looking to build something that gives back.

What Members are saying

“I can't tell you how awesome it felt to close my first winning trade! Knowing that when I clicked that button, I would be able to use that profit for a much needed date night with my wife. Thank you!”

Jon. H.

“I've been doing pretty good with stocks, but learning how to trade options has taken things to a whole new level.”

Ben C.

“This has been exactly the kind of side-hustle I was looking for. I needed someone I could trust to teach me how to get more time back and stop doing side gigs that take hours of my time and eat away at my ministry focus. Plus, I make more money with this. A double win!"

Will D.

Imagine This...

What if you could earn an extra 5–10% every month from your trading account?

Not once in a while. Not someday. But consistently. Month after month. What would you do with that extra income? How would it change the way you care for your family? What would it free you from mentally, emotionally, even spiritually?

Maybe you'd finally take your spouse on that getaway.

Maybe you'd cover an unexpected bill without fear.

Maybe you'd support a missionary or fund a ministry dream that’s been on your heart for years.

Maybe you'd stop feeling like you're behind.

This isn’t about chasing riches. It’s about creating margin so you can serve God and others with peace and confidence.

Let’s build that future together!

Read Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

The Simple Routine That Keeps Me from Overtrading

One of the most expensive mistakes I see is not picking the wrong stock or misreading a chart. It is overtrading. For years, I thought more trades meant more money. I believed activity equaled progress. Truth is, overtrading almost wrecked my account more than once. If you do not master restraint, the market will teach you the hard way.

Why Overtrading Is the Silent Account Killer

It is not the market’s volatility that drains most trading accounts, it is impatience. Every extra trade you make, especially those that are unplanned or impulsive, chips away at your long-term returns. Even small, frequent trades can cost you through commissions and slippage, often without you realizing it. Add in the emotional fatigue from constantly watching positions, second-guessing decisions, and reacting to every tick, and your mental energy gets sapped.

When you’re always looking for the next trade, you never give yourself a chance to reflect and recover from the last one. The more you chase, the more mistakes you make: rushed entries, forced exits, ignoring your own strategy. It becomes a cycle. What starts as a few “harmless” extra trades out of boredom or fear of missing out can quickly snowball into a string of losses. These small errors add up, and before you know it, you’ve wiped out months of hard-earned gains, leaving you frustrated and more likely to keep repeating the cycle.

The Signs You’re Overtrading (And Lying to Yourself)

Ask yourself: Are you being “active,” or are you just addicted to action? Overtrading hides behind all kinds of excuses: “It’s just one more trade.” “I do not want to miss out.” “I need to make back what I lost.” Sometimes it shows up as “I’m just being nimble” or “I’ll just take a quick scalp to feel productive.” If you find yourself increasing trade size after a loss, jumping in just because you are bored, taking multiple trades in rapid succession, or making decisions faster than usual, you are probably overtrading.

The urge to “do something” can feel almost overwhelming—like you have to act or you’ll fall behind—but it is rarely profitable. Overtrading is sneaky because it tricks you into thinking you are being proactive, when really you are just reacting to fear or restlessness. Real discipline is knowing when to act and, even more importantly, when to wait.

My Simple Anti-Overtrading Routine

The first rule in my routine is strict: I set a weekly limit for how many trades I will take... no exceptions. For me, that is no more than seven open positions at any given time. I spread them across different setups or strategies. Once I hit that number, I am done. I WILL NOT place any new trades until I've closed one of the ones I already have. I won't even look for new trades, because I don't want to be tempted to overtrade. This forces me to be selective.

Next, I use a pre-trade checklist before entering any position. This is not a rubber stamp, but a filter. If the trade does not fit my criteria (seasonal edge, technical setup, risk size, clear plan), I skip it. No exceptions, even if it “feels” right.

When I feel the urge to trade just because the market is moving, I have a “sit on your hands” rule. I close my trading platform, take a walk, or work on something else for at least 15 minutes. The pause almost always brings clarity. Most of the trades I was about to make impulsively are not worth it after all.

Finally, I track every trade in real time, not just at the end of the week. Seeing my activity in black and white holds me accountable and highlights any lapses in discipline before they become costly.

Restraint Is a Superpower. Here’s What Changed for Me.

When I started trading less, I began making more. My win rate went up, my profits stabilized, and I finally stopped feeling anxious about missing moves. My best students have the same story. The ones who went from “every setup” to “only the best” saw their accounts (and their confidence) grow. Missing a few trades is actually the key to catching the best ones. The market will always offer another opportunity. So if you struggle with overtrading, here's a mantra to repeat to yourself.

"No trade is better than a bad trade."

Challenge and Next Steps

Here’s my challenge for you. For the next month, make it your mission to track every single trade you take. No exceptions and no shortcuts. Write down each entry and exit as soon as it happens, along with the reason you took the trade. At the end of each week, set aside time to review your full list. Ask yourself: “How many of these trades actually fit my plan? How many were driven by boredom, FOMO, or a need to be active?” You will probably be surprised at the honest answers you find. Most people discover they are far more active than they think, and many trades could have been avoided with a little more patience. If you want my printable anti-overtrading checklist or a tracker template, let me know and I will send it your way so you can put this habit into practice and see the change for yourself.

Share your overtrading story or your results in the comments, or check out the Growth Plan for more tools and support. Trading less does not mean settling for less. It means trading smarter and building the discipline that actually makes you money.