Go beyond the basics with advanced strategies, hands-on coaching, and the ongoing support you need to trade like a pro.

Multiply Your Trading Skills and Grow Your Monthly Income Faster

You Don’t Need Another Job. You Need a Paycheck That Works on Your Terms.

You’ve probably heard it before:

“Start a side hustle.”

“Pick up some extra speaking gigs.”

“Drive for Uber in your free time.”

But deep down, you know the truth: Your time is already maxed out.

What you need is margin. Not more hustle.

What If You Could Run a Simple, Part-Time Trading Business From Your Laptop?

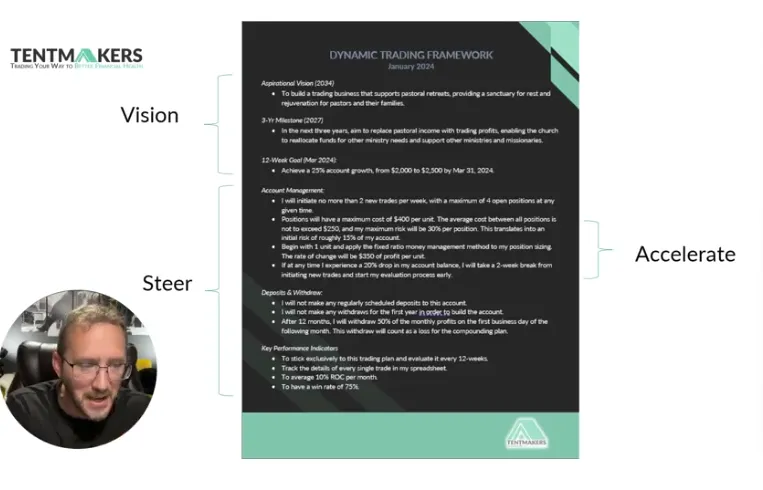

The Income Accelerator is a complete system designed to help entrepreneurial-minded pastors create withdrawable income every month using options trading.

It’s not a hobby. It’s not guesswork.

It’s a repeatable process to build a lean, flexible business that pays like a second job, without pulling you away from your first calling.

You’ll know exactly what to do, when to do it, and how to manage it.

How It Works

This isn’t “set it and forget it” investing. This is business building, with tools, structure, and strategy.

All Four Strategies: Seasonal Leverage Method, CFC, DCS, and our bonus 4th starter strategy.

Weekly Trade Alerts: Follow along with exact setups for every strategy.

Monthly Group Coaching: Live calls to review trades, sharpen your skills, and get your questions answered in real time.

Unlimited Email Support: Direct answers when you need them so you’re never trading alone.

Private Coaching Channel: Advanced trade reviews and deeper discussions with other Accelerator members.

What's Included

When you join the Income Accelerator, you get full access to:

The Options Business Course:

Learn the full framework behind this income-generating model. Taught in clear, practical lessons.

All Four Trading Strategies:

Master the complete playbook, from beginner-friendly methods to advanced setups, so you can adapt to any market condition.

Real-Time Trade Alerts:

Follow Michael’s actual trades each week. Know what to trade, when, and why.

Monthly Group Coaching Calls:

Get feedback, troubleshoot your trades, and grow with a like-minded community.

Unlimited Email Support:

Run your trading like a system, not a guessing game.

Supportive Private Group:

Be part of a network of pastors and ministry leaders building the same kind of freedom you are.

Real Results. Real Income.

This isn’t theory. These are actual results.

Since launching the Income Plan in April 2023, Michael has placed 221 trades with a 79.6% win rate, using the same strategy shared in this program.

Started the portfolio in April 2023 with a $2,000 account.

Earned $11,437 in profit over 24 months!

Average Monthly ROI: 5.9%!

Average Monthly Income: $477!

Only 2 Losing Months: 91.7% winning months!

That’s not flashy day trading. That’s consistent, repeatable income—built with focus, discipline, and a strategy that works.

If a $2,000 account can generate nearly $12K in profit in two years, imagine what this could mean for your family, your ministry, or your financial peace of mind.

While results are never guaranteed and losses are always possible, many Accelerator members report profit potential in the $500–$700/month range as they gain confidence and consistency with all four strategies.

PRICING

Choose Your Plan

Foundations

$97/mo

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for SLM and MIS strategies

Access to member community

Downloadable checklists, templates, and guides

Up to 3 questions per month, responses within 48 hours

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective Course

Double Canopy Strategy Course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

Income Accelerator

$197/mo

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for all four strategies

Access to member community

Downloadable checklists, templates, and guides

Unlimited questions, priority same-day response

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective course

Double Canopy Strategy course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

Get 2 Mo FREE

$1,970/yr

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for all four strategies

Access to member community

Downloadable checklists, templates, and guides

Unlimited questions, priority same-day response

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective course

Double Canopy Strategy course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

For Pastors Who Think Like Entrepreneurs

Wants to provide more for your family without overextending your time

Believes financial margin creates ministry freedom

Is ready to treat income generation with the same intentionality as discipleship

Doesn’t want hype, just a method that works

Is willing to learn, apply, and grow

You're not just looking to invest.

You're looking to build something that gives back.

What Members are saying

“I can't tell you how awesome it felt to close my first winning trade! Knowing that when I clicked that button, I would be able to use that profit for a much needed date night with my wife. Thank you!”

Jon. H.

“I've been doing pretty good with stocks, but learning how to trade options has taken things to a whole new level.”

Ben C.

“This has been exactly the kind of side-hustle I was looking for. I needed someone I could trust to teach me how to get more time back and stop doing side gigs that take hours of my time and eat away at my ministry focus. Plus, I make more money with this. A double win!"

Will D.

Imagine This...

What if you could earn an extra 5–10% every month from your trading account?

Not once in a while. Not someday. But consistently. Month after month. What would you do with that extra income? How would it change the way you care for your family? What would it free you from mentally, emotionally, even spiritually?

Maybe you'd finally take your spouse on that getaway.

Maybe you'd cover an unexpected bill without fear.

Maybe you'd support a missionary or fund a ministry dream that’s been on your heart for years.

Maybe you'd stop feeling like you're behind.

This isn’t about chasing riches. It’s about creating margin so you can serve God and others with peace and confidence.

Let’s build that future together!

Read Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

The Basics of Backtesting Your Strategy (And Why It’s Not Enough)

Most traders love the idea of backtesting. It feels safe. You get to test your strategy on past charts, plug numbers into spreadsheets, and see a clean curve of “what would have happened.” On paper, it looks controlled, logical, and even exciting.

But here is my honest take: I am not a big fan of backtesting. It is too easy to manipulate the numbers, even without realizing it. It is too easy to add unintentional bias into the results. And most of all, it is a completely different ballgame when real money is on the line.

Backtesting is useful, but it is not the finish line. At best, it is a filter to see if an idea even has a chance of working. If you stop at backtesting, you will almost always be disappointed. The real edge comes when you take that idea through a full testing process, from charts, to practice, to forward testing, and finally scaling up when you have proof.

The Limited Value of Backtesting

Backtesting does one important thing: it shows you if your strategy has any basic viability. If you run a test and the numbers are consistently negative, you know right away to scrap that idea. You save yourself time, energy, and money.

That is where the real value ends. Backtesting is not about perfection, and it should never convince you to dump your entire account into a shiny new strategy. Perfect-looking results on past charts can be dangerously misleading. The market is too dynamic, and conditions change too often for a backtest to guarantee future performance.

The reality is that you can backtest almost anything and make it look good if you tweak the rules enough. That kind of curve-fitting may build confidence on paper, but it almost always falls apart in real time.

The Problem with Bias

The biggest weakness of backtesting is bias. Even if you try to be honest, bias sneaks in.

Hindsight bias: You already know what happened in the past, so your brain naturally cheats when deciding where to “enter” or “exit.”

Rule drift: You start bending your own rules mid-test because you want to see a better outcome.

Overfitting: You tweak and tweak until your system only works on the exact past data you tested.

The outcome is a backtest that looks bulletproof. On the charts, it seems like you have found the secret formula. But the first time you put real money on it, it fails, and usually in a way that shakes your confidence. That gap between theory and execution is wide and unforgiving. It is the graveyard of most new traders, the place where hope meets reality. Many people never climb out of that hole because they trusted results that were only valid in hindsight, not in real life. When you realize this, you see that the danger is not just the failed trade, but the false sense of security that a perfect-looking backtest created.

Why Real Money Changes Everything

Here is the truth: trading with fake or past data does not prepare you for what it feels like when your own money is truly on the line.

The psychology is completely different and it cannot be overstated. A backtest does not capture what happens when you see three losses in a row and start doubting your system, when your pulse quickens as you hover over the sell button, or when you hesitate because you fear missing out. It does not measure the way greed pushes you to hold too long, or the panic that causes you to exit far too early, leaving money on the table.

The gut punch of a real losing streak cannot be simulated by data alone, no matter how clean the spreadsheet looks. And the confidence of seeing your system actually work in real time cannot be replaced by any amount of backtesting. That is why backtesting is just the warmup, not the game, and why every trader must accept that the lessons that matter most only come when real money is involved and real discipline is tested day after day.

A Smarter Testing Path

So what is the better approach? Here is the path I recommend.

Backtest LightlyRun your idea through past charts just enough to see if it makes sense. If it fails completely, drop it. If it looks promising, move forward.

Practice Test (Paper Trading)Trade the system live, but without money. This builds muscle memory, lets you refine your rules, and shows you if you can follow your plan without pressure.

Forward Test (Small Real Trades)Place tiny trades with actual money. The goal is not profit. The goal is to experience real emotions and see if you can stick to your rules.

Sample TestCommit to 20–30 trades in a row, recorded in detail. Do not judge after one or two. At the end of the sample, review win rate, average gain vs. loss, and how you felt.

Scale SlowlyOnly increase position size after you have proven consistency in small size. Growth should follow evidence, not emotion.

This path takes longer, but it keeps you from blowing up an account just because a backtest looked good.

The Right Mindset for Testing

Backtesting is the start, not the proof. Think of it like drawing up a playbook in sports. The play might look brilliant on paper, but it only matters once it works on the field.

Your goal is not to chase flawless charts or dream about the perfect system. Your goal is to build confidence that you can execute a strategy through good seasons and bad. That confidence only comes from practice and real experience.

When you adopt this mindset, testing stops being about “finding a holy grail” and becomes about proving to yourself that you can do the right thing at the right time, even when it is hard. That is the foundation of consistent trading.

Challenge and Next Step

So here is my challenge to you. Take one idea and put it through the process. Do a simple backtest to check for basic viability. Then forward test it for 20 trades with the smallest size possible. Keep records, track your emotions, and judge your performance by your discipline, not just the dollars.

At the end of those 20 trades, review your results. Do you have something worth scaling? Or do you need to refine the plan? Either way, you will have real data and real experience, not just pretty charts.

If you want a printable backtesting and forward testing tracker, or if you want to join a community where strategies are already run through this process, reach out and I will send you the tools.

Do not fall for the trap of perfect backtests. Build a system that works in real life, with real money, and you will finally trade with confidence.