Start Investing with Confidence, Even If You’re Brand New

This free bootcamp is your first step toward confident investing. In just a few short lessons, you’ll learn a simple system you can actually use.

Most church leaders feel overwhelmed by money and unsure where to even start.

This bootcamp gives beginners a safe, step-by-step way to invest without jargon or complexity.

Imagine the peace of finally knowing how to grow your savings with confidence and consistency.

What You’ll Learn

How stocks actually work and why you don’t need Wall Street experience to invest.

How to open your first brokerage account with step-by-step instructions.

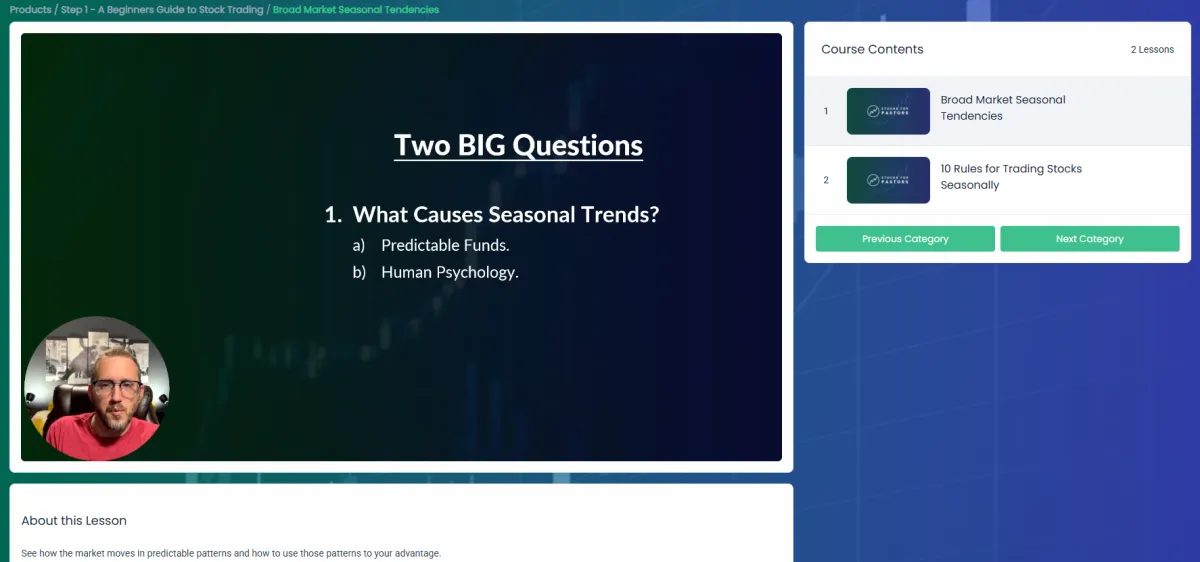

What seasonal investing is and why it gives beginners a unique edge.

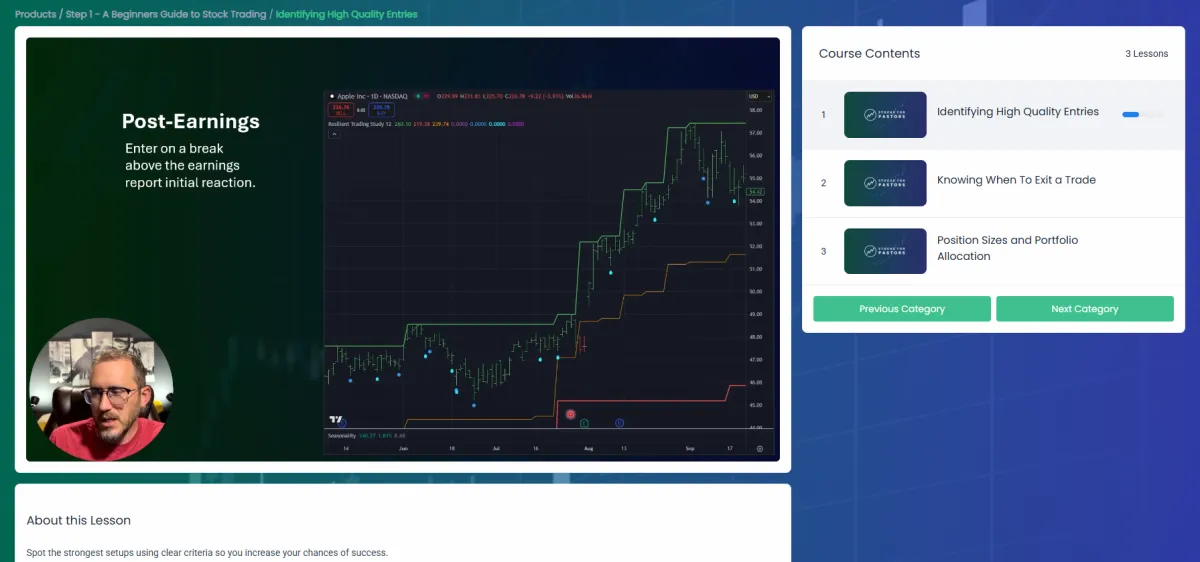

A simple trading system that helps you decide when to buy and sell.

First steps for new investors so you can start with confidence, not confusion.

Why Seasonal Investing Works

Seasonal investing is built on predictable, recurring patterns in the market. Think of it like planting in the right season: some months are better for certain stocks than others. By learning these patterns, you can make informed trades that reduce guesswork and increase confidence.

This training walks you through the process step by step, so you can take advantage of these patterns without spending hours in front of charts.

This Bootcamp was built for busy leaders who don’t want another endless online course. It’s short, focused, and designed to get you moving right away.

Who This Is For?

The First-Time Investor

You’ve never bought a stock in your life, and you want someone to walk you through the basics without making you feel dumb.The Frustrated Dabbler

You’ve bought stocks here and there, maybe even followed tips or trends, but you’ve never seen consistent results. You’re ready for a proven system that actually works over time.The Overwhelmed Saver

You’ve tried saving, but it feels slow and discouraging. You want a way to actually grow your money instead of watching it sit there.The Busy Leader

You don’t have hours each week to watch charts or read financial reports. You need a simple plan that fits into your real schedule.

I've been a pastor for over 25 years and an investing coach for more than 15. My mission is to help leaders like you build financial resilience so you can focus on your calling.

"I don’t believe in get-rich-quick schemes. This course teaches the same steady approach I’ve used for years to help leaders grow their savings without stress."

This is the system you’ll learn in the Bootcamp. I've been trading it personally for years and have teaching it to leaders like you since 2018.

Average 2–3% ROI per month for the past 7 years

Turned $1,000 into $5,000 in 2 years using this exact system

Repeatable trades built on seasonal patterns with a high win rate

Here’s what other leaders who started right where you are Have to Say about their experience with Stocks for Pastors.

“I never thought investing was something I could do, but this gave me confidence, clarity, and a clear path forward.”

Joel S.

“My account has nearly doubled in 18 months since I started with Stocks for Pastors.”

Eric B.

“Michael’s course has helped me see a clear path to advance my family financially. It is doable and attainable- exactly like he said it would be."

Dave C.

Everything You Need, Right Here

This Bootcamp is not a teaser or a sales pitch. It’s a complete, beginner-friendly system you can use to start investing with confidence. You don’t need to buy anything else to make this work.

In just a few short trainings, you’ll know how to open your account, spot seasonal opportunities, and place your first trade with a proven process.

No fluff. No missing pieces. Just a clear path you can follow starting today.

Read Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

The Basics of Backtesting Your Strategy (And Why It’s Not Enough)

Most traders love the idea of backtesting. It feels safe. You get to test your strategy on past charts, plug numbers into spreadsheets, and see a clean curve of “what would have happened.” On paper, it looks controlled, logical, and even exciting.

But here is my honest take: I am not a big fan of backtesting. It is too easy to manipulate the numbers, even without realizing it. It is too easy to add unintentional bias into the results. And most of all, it is a completely different ballgame when real money is on the line.

Backtesting is useful, but it is not the finish line. At best, it is a filter to see if an idea even has a chance of working. If you stop at backtesting, you will almost always be disappointed. The real edge comes when you take that idea through a full testing process, from charts, to practice, to forward testing, and finally scaling up when you have proof.

The Limited Value of Backtesting

Backtesting does one important thing: it shows you if your strategy has any basic viability. If you run a test and the numbers are consistently negative, you know right away to scrap that idea. You save yourself time, energy, and money.

That is where the real value ends. Backtesting is not about perfection, and it should never convince you to dump your entire account into a shiny new strategy. Perfect-looking results on past charts can be dangerously misleading. The market is too dynamic, and conditions change too often for a backtest to guarantee future performance.

The reality is that you can backtest almost anything and make it look good if you tweak the rules enough. That kind of curve-fitting may build confidence on paper, but it almost always falls apart in real time.

The Problem with Bias

The biggest weakness of backtesting is bias. Even if you try to be honest, bias sneaks in.

Hindsight bias: You already know what happened in the past, so your brain naturally cheats when deciding where to “enter” or “exit.”

Rule drift: You start bending your own rules mid-test because you want to see a better outcome.

Overfitting: You tweak and tweak until your system only works on the exact past data you tested.

The outcome is a backtest that looks bulletproof. On the charts, it seems like you have found the secret formula. But the first time you put real money on it, it fails, and usually in a way that shakes your confidence. That gap between theory and execution is wide and unforgiving. It is the graveyard of most new traders, the place where hope meets reality. Many people never climb out of that hole because they trusted results that were only valid in hindsight, not in real life. When you realize this, you see that the danger is not just the failed trade, but the false sense of security that a perfect-looking backtest created.

Why Real Money Changes Everything

Here is the truth: trading with fake or past data does not prepare you for what it feels like when your own money is truly on the line.

The psychology is completely different and it cannot be overstated. A backtest does not capture what happens when you see three losses in a row and start doubting your system, when your pulse quickens as you hover over the sell button, or when you hesitate because you fear missing out. It does not measure the way greed pushes you to hold too long, or the panic that causes you to exit far too early, leaving money on the table.

The gut punch of a real losing streak cannot be simulated by data alone, no matter how clean the spreadsheet looks. And the confidence of seeing your system actually work in real time cannot be replaced by any amount of backtesting. That is why backtesting is just the warmup, not the game, and why every trader must accept that the lessons that matter most only come when real money is involved and real discipline is tested day after day.

A Smarter Testing Path

So what is the better approach? Here is the path I recommend.

Backtest LightlyRun your idea through past charts just enough to see if it makes sense. If it fails completely, drop it. If it looks promising, move forward.

Practice Test (Paper Trading)Trade the system live, but without money. This builds muscle memory, lets you refine your rules, and shows you if you can follow your plan without pressure.

Forward Test (Small Real Trades)Place tiny trades with actual money. The goal is not profit. The goal is to experience real emotions and see if you can stick to your rules.

Sample TestCommit to 20–30 trades in a row, recorded in detail. Do not judge after one or two. At the end of the sample, review win rate, average gain vs. loss, and how you felt.

Scale SlowlyOnly increase position size after you have proven consistency in small size. Growth should follow evidence, not emotion.

This path takes longer, but it keeps you from blowing up an account just because a backtest looked good.

The Right Mindset for Testing

Backtesting is the start, not the proof. Think of it like drawing up a playbook in sports. The play might look brilliant on paper, but it only matters once it works on the field.

Your goal is not to chase flawless charts or dream about the perfect system. Your goal is to build confidence that you can execute a strategy through good seasons and bad. That confidence only comes from practice and real experience.

When you adopt this mindset, testing stops being about “finding a holy grail” and becomes about proving to yourself that you can do the right thing at the right time, even when it is hard. That is the foundation of consistent trading.

Challenge and Next Step

So here is my challenge to you. Take one idea and put it through the process. Do a simple backtest to check for basic viability. Then forward test it for 20 trades with the smallest size possible. Keep records, track your emotions, and judge your performance by your discipline, not just the dollars.

At the end of those 20 trades, review your results. Do you have something worth scaling? Or do you need to refine the plan? Either way, you will have real data and real experience, not just pretty charts.

If you want a printable backtesting and forward testing tracker, or if you want to join a community where strategies are already run through this process, reach out and I will send you the tools.

Do not fall for the trap of perfect backtests. Build a system that works in real life, with real money, and you will finally trade with confidence.