Start Investing with Confidence, Even If You’re Brand New

This free bootcamp is your first step toward confident investing. In just a few short lessons, you’ll learn a simple system you can actually use.

Most church leaders feel overwhelmed by money and unsure where to even start.

This bootcamp gives beginners a safe, step-by-step way to invest without jargon or complexity.

Imagine the peace of finally knowing how to grow your savings with confidence and consistency.

What You’ll Learn

How stocks actually work and why you don’t need Wall Street experience to invest.

How to open your first brokerage account with step-by-step instructions.

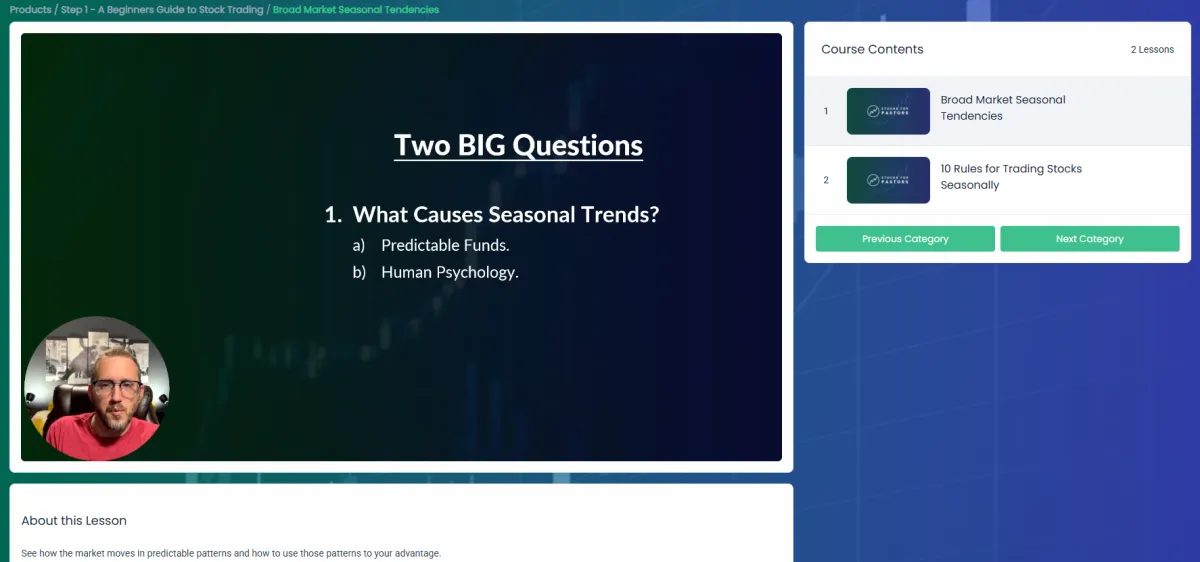

What seasonal investing is and why it gives beginners a unique edge.

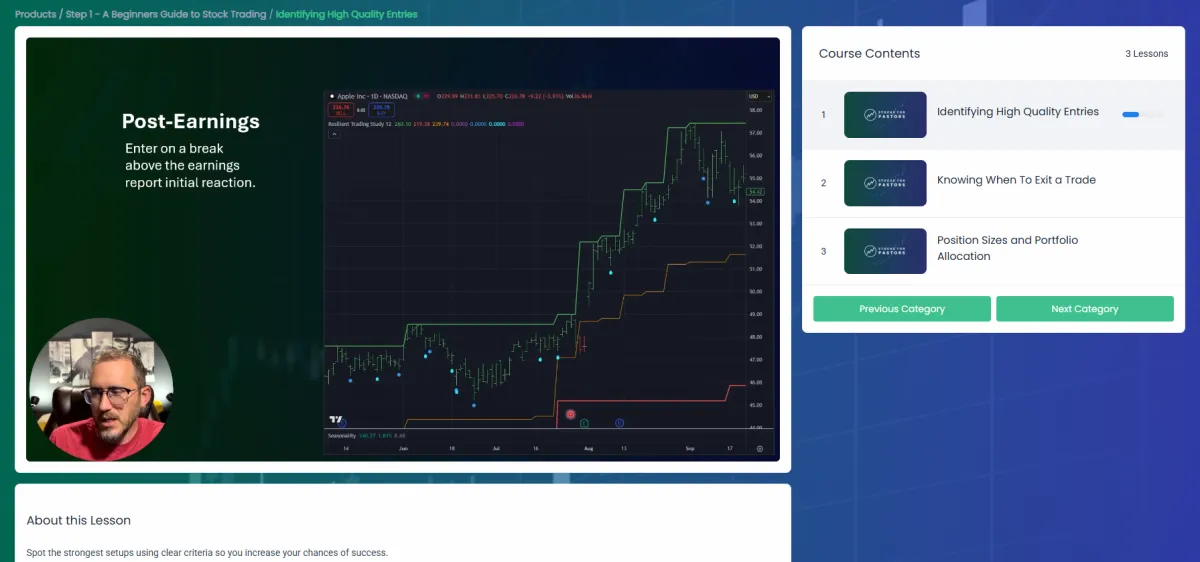

A simple trading system that helps you decide when to buy and sell.

First steps for new investors so you can start with confidence, not confusion.

Why Seasonal Investing Works

Seasonal investing is built on predictable, recurring patterns in the market. Think of it like planting in the right season: some months are better for certain stocks than others. By learning these patterns, you can make informed trades that reduce guesswork and increase confidence.

This training walks you through the process step by step, so you can take advantage of these patterns without spending hours in front of charts.

This Bootcamp was built for busy leaders who don’t want another endless online course. It’s short, focused, and designed to get you moving right away.

Who This Is For?

The First-Time Investor

You’ve never bought a stock in your life, and you want someone to walk you through the basics without making you feel dumb.The Frustrated Dabbler

You’ve bought stocks here and there, maybe even followed tips or trends, but you’ve never seen consistent results. You’re ready for a proven system that actually works over time.The Overwhelmed Saver

You’ve tried saving, but it feels slow and discouraging. You want a way to actually grow your money instead of watching it sit there.The Busy Leader

You don’t have hours each week to watch charts or read financial reports. You need a simple plan that fits into your real schedule.

I've been a pastor for over 25 years and an investing coach for more than 15. My mission is to help leaders like you build financial resilience so you can focus on your calling.

"I don’t believe in get-rich-quick schemes. This course teaches the same steady approach I’ve used for years to help leaders grow their savings without stress."

This is the system you’ll learn in the Bootcamp. I've been trading it personally for years and have teaching it to leaders like you since 2018.

Average 2–3% ROI per month for the past 7 years

Turned $1,000 into $5,000 in 2 years using this exact system

Repeatable trades built on seasonal patterns with a high win rate

Here’s what other leaders who started right where you are Have to Say about their experience with Stocks for Pastors.

“I never thought investing was something I could do, but this gave me confidence, clarity, and a clear path forward.”

Joel S.

“My account has nearly doubled in 18 months since I started with Stocks for Pastors.”

Eric B.

“Michael’s course has helped me see a clear path to advance my family financially. It is doable and attainable- exactly like he said it would be."

Dave C.

Everything You Need, Right Here

This Bootcamp is not a teaser or a sales pitch. It’s a complete, beginner-friendly system you can use to start investing with confidence. You don’t need to buy anything else to make this work.

In just a few short trainings, you’ll know how to open your account, spot seasonal opportunities, and place your first trade with a proven process.

No fluff. No missing pieces. Just a clear path you can follow starting today.

Read Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

How to Layer Seasonal Stock Setups with Options for Extra Income

How to Layer Seasonal Stock Setups with Options for Extra Income

Most traders stop at stock-only setups. That is fine, but it leaves money on the table. The reality is that a stock-only approach gives you exposure to the move but often ignores the other tools available to amplify returns and control risk. Seasonal trading gives you an edge in direction and timing, but pairing that with options creates another income stream without multiplying risk. Options allow you to capture premium, lock in defined losses, and add leverage in a controlled way. This blend transforms a single trade idea into a multi-layered opportunity. When done with discipline, layering also smooths out performance by letting you earn even when the stock only makes a partial move. This article will walk through why layering matters, how I do it, and what rules keep it safe, so you can see how the combination works in real trading conditions.

Why Layering Matters

Seasonal setups are based on real historical data. If a stock has outperformed in November 70 percent of the time for 20 years, that is not a coincidence. It is a repeatable edge. But even with that edge, trading the stock alone limits you to the price move itself. By layering an options strategy on top of the seasonal bias, you give yourself two ways to win. You profit from the stock’s move, and you collect premium or leverage depending on the strategy. Done right, this increases your consistency and income without needing more trades.

The Foundation — Seasonal Stock Setups

Seasonal setups are the backbone of this approach. Before adding anything else, you need the stock trade itself to be solid. I only consider seasonal moves with 10–20 years of data, strong win frequency, and an average move of at least 3 percent. If the seasonal pattern is bullish, I want price in the upper half of its recent range and confirmation from anchored VWAP. If the pattern is bearish, I want price in the lower half and similar confirmation. Without this foundation, no options strategy will save the trade.

Adding the Options Layer

Once the seasonal edge is in place, I look at which options structure fits best.

Credit spreads: When I expect a mild move, I sell premium. Even if the stock drifts in my direction, I collect income.

Debit spreads: When conviction is high for a strong breakout, I buy spreads. This gives me leverage with limited risk.

Calendars or diagonals: When I want both time decay and directional bias, I layer these in. They are especially useful when volatility is low and expected to rise.

The key is picking one layer that matches the conviction level. Do not overcomplicate it by stacking multiple spreads on top of each other. Traders often think more is better, but in reality layering too many strategies creates confusion, overlapping risk, and difficulty in tracking results. A single, well-chosen options structure tied to a strong seasonal setup will perform far better than three half-baked ideas thrown together. Keeping it simple also makes it easier to review your trades later, since you can clearly see whether the seasonal move or the options layer drove the results. This clarity is what helps you refine your process and scale with confidence.

Step-by-Step Example

Let’s say a stock has a 75 percent win rate in December with an average 6 percent gain. Current price action shows higher lows and anchored VWAP support. That is my seasonal setup. Instead of just buying shares, I can sell a bullish put credit spread. If the stock rises, I keep the premium. If it rises even more, I still win, because the stock move plus the spread both pay. The layering creates a smoother income stream and cushions me if the move is smaller than the historical average.

This also changes how I manage the trade. With shares alone, my only choices are hold or sell. With a spread layered in, I can set clear profit targets, manage risk to the penny, and even roll the position forward if conditions remain favorable. It is like having multiple levers to pull instead of being locked into one outcome. This approach also means that even if the seasonal edge produces only a modest move of two or three percent, the options layer can turn that into a meaningful return, while keeping losses defined if the stock unexpectedly reverses.

The point of the example is not just to show a single trade but to demonstrate how layering transforms the way you participate in a seasonal move and gives you a more flexible playbook.

Rules for Layering Without Confusion

One seasonal setup = one options layer. Keep it simple.

Always define risk. Every spread should have capped downside.

Never increase size just because you are adding options. Position sizing rules apply to the whole trade, not each piece.

Avoid overlapping strategies that compete with each other. If you sell a credit spread, do not also buy a call spread in the same trade window. Pick one.

The Payoff of Layering

Layering seasonal setups with options gives you two edges. You use history and probabilities to guide timing, and you use options to turn that timing into consistent income. This combination means you do not need massive stock moves to get paid. Even small seasonal moves can generate real profit when the right options layer is added. It also provides a psychological benefit: knowing that you have multiple ways to profit from the same trade helps reduce stress and second-guessing.

Instead of hoping for a large breakout, you are positioned to win from both movement and premium decay. Over time this steadier flow of results helps you stay disciplined and avoid the temptation to chase trades outside your plan. The payoff is not just more income, but also greater confidence that your system is built to work in different types of markets.

Take Your Next Step Toward Higher Profits

Seasonal trading gives you clarity. Options give you leverage. When you combine them carefully, you can create reliable income without taking reckless risks. The goal is not to trade more, but to trade smarter. Learn to layer your seasonal setups with the right options strategies, and you will see how much stronger your results can become.

The traders who last are the ones who understand that adding layers is not about chasing more profit, but about improving probability and consistency. If you build a routine of pairing your strongest seasonal edges with one well-chosen options strategy, you will gradually turn trading into a reliable process rather than a series of guesses. That process compounds over time, giving you both financial growth and peace of mind.

If you are ready to take the next step, join the Foundations community where we put these strategies into practice every week. Inside, you will learn exactly how to apply options to your seasonal setups with real examples and live guidance, so you can stop guessing and start trading with clarity and confidence.