Start Investing with Confidence, Even If You’re Brand New

This free bootcamp is your first step toward confident investing. In just a few short lessons, you’ll learn a simple system you can actually use.

Most church leaders feel overwhelmed by money and unsure where to even start.

This bootcamp gives beginners a safe, step-by-step way to invest without jargon or complexity.

Imagine the peace of finally knowing how to grow your savings with confidence and consistency.

What You’ll Learn

How stocks actually work and why you don’t need Wall Street experience to invest.

How to open your first brokerage account with step-by-step instructions.

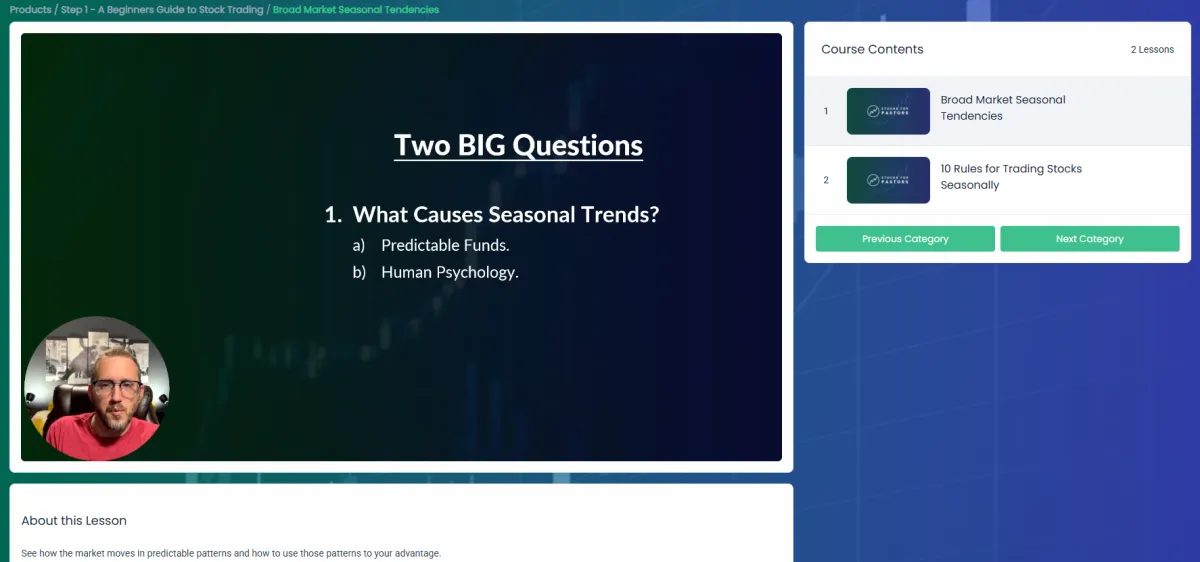

What seasonal investing is and why it gives beginners a unique edge.

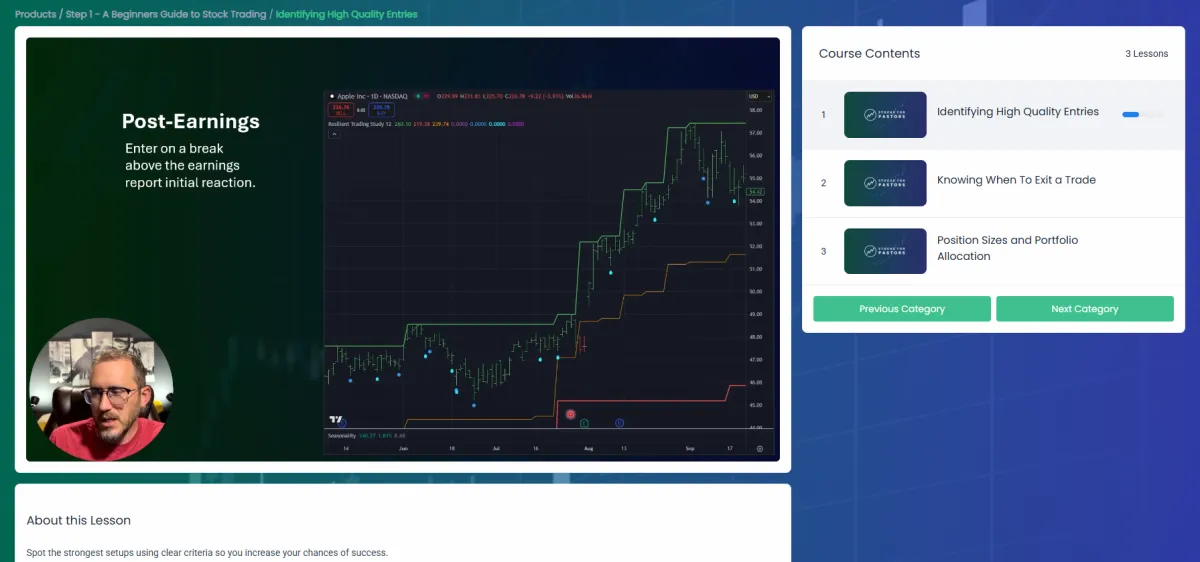

A simple trading system that helps you decide when to buy and sell.

First steps for new investors so you can start with confidence, not confusion.

Why Seasonal Investing Works

Seasonal investing is built on predictable, recurring patterns in the market. Think of it like planting in the right season: some months are better for certain stocks than others. By learning these patterns, you can make informed trades that reduce guesswork and increase confidence.

This training walks you through the process step by step, so you can take advantage of these patterns without spending hours in front of charts.

This Bootcamp was built for busy leaders who don’t want another endless online course. It’s short, focused, and designed to get you moving right away.

Who This Is For?

The First-Time Investor

You’ve never bought a stock in your life, and you want someone to walk you through the basics without making you feel dumb.The Frustrated Dabbler

You’ve bought stocks here and there, maybe even followed tips or trends, but you’ve never seen consistent results. You’re ready for a proven system that actually works over time.The Overwhelmed Saver

You’ve tried saving, but it feels slow and discouraging. You want a way to actually grow your money instead of watching it sit there.The Busy Leader

You don’t have hours each week to watch charts or read financial reports. You need a simple plan that fits into your real schedule.

I've been a pastor for over 25 years and an investing coach for more than 15. My mission is to help leaders like you build financial resilience so you can focus on your calling.

"I don’t believe in get-rich-quick schemes. This course teaches the same steady approach I’ve used for years to help leaders grow their savings without stress."

This is the system you’ll learn in the Bootcamp. I've been trading it personally for years and have teaching it to leaders like you since 2018.

Average 2–3% ROI per month for the past 7 years

Turned $1,000 into $5,000 in 2 years using this exact system

Repeatable trades built on seasonal patterns with a high win rate

Here’s what other leaders who started right where you are Have to Say about their experience with Stocks for Pastors.

“I never thought investing was something I could do, but this gave me confidence, clarity, and a clear path forward.”

Joel S.

“My account has nearly doubled in 18 months since I started with Stocks for Pastors.”

Eric B.

“Michael’s course has helped me see a clear path to advance my family financially. It is doable and attainable- exactly like he said it would be."

Dave C.

Everything You Need, Right Here

This Bootcamp is not a teaser or a sales pitch. It’s a complete, beginner-friendly system you can use to start investing with confidence. You don’t need to buy anything else to make this work.

In just a few short trainings, you’ll know how to open your account, spot seasonal opportunities, and place your first trade with a proven process.

No fluff. No missing pieces. Just a clear path you can follow starting today.

Read Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Structuring Chart Reviews: Before, During, and After a Trade

Most traders only look at charts when they want to place a trade. That limited view leaves them blind to the bigger picture and often results in missed opportunities or unnecessary losses. The best traders know that charts must be reviewed at three stages: before entering, while in the trade, and after the trade is closed. This approach ensures you always have context, understand how your setup is unfolding, and capture lessons for the future. This simple structure sharpens discipline, reveals mistakes, builds confidence over time, and creates a repeatable process you can rely on instead of reacting on impulse.

Why Structured Reviews Matter

Without structured reviews, you are guessing and leaving your results up to chance. A chart review gives you a framework to test your analysis, evaluate your decisions, and see how well your strategy actually performs over time. It ensures you know exactly what you are risking before entry, whether your trade is behaving as expected while it is live, and what you can learn after it is over. Reviews turn every trade into a teacher and create a cycle of continuous feedback that sharpens your edge. The outcome matters, but the process matters more, because process is what can be repeated and improved no matter what the short-term results look like.

Chart Review Before a Trade

Before entry, I run through a clear checklist:

Seasonal context: Does the stock have a historical tendency to move in this period?

Support and resistance: Are the levels clear and tradable?

Anchored VWAP: Is price respecting key VWAP zones tied to earnings or swing highs/lows?

Defined risk and target: Is my stop in place, and is the target realistic based on historical moves?

At this stage, I also record my planned entry, stop, and target in my trading log. This keeps me accountable and gives me a written reference to check later. I often add a quick note about why I chose those levels so I can evaluate my reasoning afterward. If I cannot clearly write down the setup with confidence and explain why it makes sense, I do not take it. This extra step forces clarity and prevents me from entering trades just because I feel impatient or afraid of missing out.

Chart Review During a Trade

Once in a trade, my goal is to monitor, not micromanage. I look at how price behaves relative to the plan. Is it holding the VWAP level I expected? Is volume confirming strength or weakness? Are broader market conditions supporting or fighting my trade?

I also note unusual events in real time. If news breaks, volatility spikes, or a sudden reversal appears, I write it down. This helps me avoid emotional overreactions because I have a record of what is happening and how I responded. The key is to stay within the framework I set before entry. Monitoring keeps me engaged, but the plan keeps me disciplined.

Chart Review After a Trade

When the trade is closed, the real learning begins. I compare the outcome against my plan:

Did the stock respect my levels?

Did I follow my entry and exit rules?

Was the stop placed in the right spot?

Did I cut winners too soon, or did I let losers run too long?

I capture screenshots of the chart and store them with my notes. Over time, this builds a personal playbook of setups that I can revisit again and again. Patterns begin to stand out more clearly when you have dozens of charts side by side, showing you not only what worked but also what consistently failed. These reviews highlight subtle details such as the quality of a breakout candle, the strength of a VWAP test, or the difference between a clean seasonal move and a choppy one. Reviewing after the fact is what turns raw experience into structured growth, because it transforms each trade from a single event into part of a broader training program that keeps sharpening your edge.

Example Walkthrough

Recently I took a trade with a strong seasonal edge in September. Before entry, I confirmed that price was in the upper half of its 12-week range, anchored VWAP from earnings was holding as support, and volume was trending above average. I planned the entry near VWAP with a target based on the historical average move of 4 percent. During the trade, I noted how the stock respected VWAP for three straight days and how volume spikes lined up with intraday rallies. After the trade closed successfully, I saved the chart, compared my notes, and confirmed that following the plan created the result. That review reinforced the process and gave me a model to repeat.

Key Rules for Chart Reviews

Keep reviews short but consistent. They should not take more than a few minutes per stage.

Focus on process, not outcome. The goal is to refine discipline, not celebrate wins or mourn losses.

Make reviews a habit. The more consistent the reviews, the faster your growth curve.

Final Word

A structured chart review is one of the fastest ways to improve as a trader. It forces you to slow down, test your plan, and learn from every decision. Before, during, and after... each stage has lessons to teach and patterns to reveal that you might miss without a disciplined process. If you build this into your routine, your discipline and results will grow together, because you are no longer leaving your growth to chance but actively shaping it with every trade. And if you want to see how I apply reviews in real trades each week, join the Foundations community where I share my full process with members in real time, complete with screenshots, notes, and live breakdowns you can model for yourself.