Learn two beginner-friendly strategies, follow weekly alerts, and join a community that helps you see $100–$300/month potential without overwhelm.

Build the Skills to Trade Confidently and Create Steady Income

Let’s Talk About the Quiet Financial Pressure Most Pastors Carry

You’re not lazy. You’re not irresponsible.

You’ve just been so focused on helping others that your own financial future got pushed to the side. Maybe…

You’ve contributed to a retirement account here and there, but it’s nowhere near enough.

You’ve looked at the stock market before and thought, “I don’t have time to figure this out.”

You’ve wondered if you’ll have to keep working long after you want to stop, just to make ends meet.

You’ve even considered a second job or side hustle... but the thought of it wears you out.

You're not alone.

Thousands of pastors are in the same boat and they're quietly anxious about what the future holds.

But here's the truth:

You don’t need more time or more stress. You just need a smarter way to grow what you already have.

It’s a simple, proven investing system designed specifically for pastors who want to build wealth for the long haul; without financial stress, guesswork, or complicated strategies.

You don’t need a finance degree. You don’t need thousands of dollars.

All you need is a desire to take control of your future, and a guide who understands your world.

What You’ll Gain

Clarity on exactly when to enter and exit trades

Two proven strategies that fit into your schedule

Monthly watchlist of high-probability stock setups

Weekly trade alerts so you can follow along with confidence

Supportive community to keep you motivated and learning

Direct answers when you have questions

Why New Traders Succeed Faster in Foundations

Built by a pastor who understands the financial challenges ministry leaders face

Strategies tested and refined with years of real-world results

A step-by-step learning path that meets you where you are

A community that values wisdom, stewardship, and intentional growth

While nothing is guaranteed in trading and there is always a risk of losing, many members report seeing $100–$300/month potential within their first few months of joining. The real win is gaining the skills and confidence to make disciplined, repeatable trades.

PRICING

Choose Your Plan

Foundations

$97/mo

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for SLM and MIS strategies

Access to member community

Downloadable checklists, templates, and guides

Up to 3 questions per month, responses within 48 hours

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective Course

Double Canopy Strategy Course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

Income Accelerator

$197/mo

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for all four strategies

Access to member community

Downloadable checklists, templates, and guides

Unlimited questions, priority same-day response

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective course

Double Canopy Strategy course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

Get 2 Mo FREE

$1,970/yr

Beginner-friendly video course that walks you through every step

Monthly seasonal watchlist of high-probability stocks

Real-time trade alerts for all four strategies

Access to member community

Downloadable checklists, templates, and guides

Unlimited questions, priority same-day response

Seasonal Leverage Method course

Monthly Income Strategy course

Cash Flow Collective course

Double Canopy Strategy course

Monthly live group coaching calls

2 free months

1:1 onboarding video chat and initial coaching session

No contracts - cancel anytime

What Members are saying

“I never thought investing was something I could do, but this gave me confidence, clarity, and a clear path forward.”

Joel S.

“My account has nearly doubled in 18 months since I started with Stocks for Pastors.”

Eric B.

“Michael’s course has helped me see a clear path to advance my family financially. It is doable and attainable- exactly like he said it would be."

Dave C.

Start Building Your Trading Foundation Today

Learn two simple strategies, follow weekly trade alerts, and join a supportive community that helps you grow with confidence.

Read Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

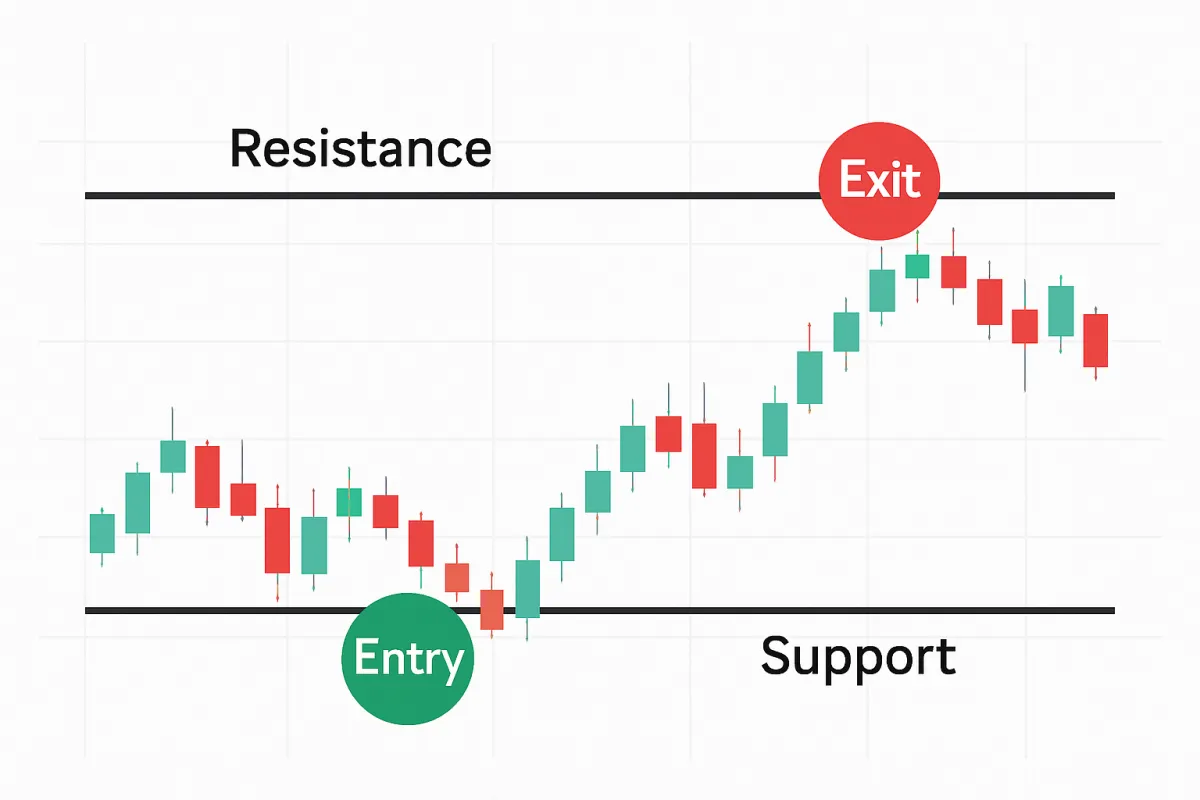

Entry and Exit: How I Pick My Price Levels

Most traders focus on picking the right stock or the right strategy, but they forget that the actual price levels of entry and exit are just as important. You can be correct on direction and still lose money if you enter too late or exit too early. Learning how to pick price levels is what turns a good idea into a profitable trade.

Why Levels Matter

Price levels create structure. They tell you where risk is defined and where reward is realistic. If you buy too high, your risk balloons. If you sell too early, you cut your own profits short. Getting this wrong leaves you frustrated even when your analysis is correct. Getting it right means you control risk from the start and give yourself room to capture the reward. In short, levels are the framework that keeps your trading disciplined.

Tools I Use

I do not overcomplicate this. I focus on a few proven tools:

Support and resistance: These are the places where price has reacted before. They are natural boundaries for entries and exits.

Anchored VWAP: My favorite tool for spotting institutional zones. When price respects VWAP anchored to earnings or swing highs, I know big money is paying attention.

Seasonal context: If history shows a stock tends to move higher in a certain month, I use that to increase my conviction.

12-week range positioning: I want bullish trades in the upper half of the range and bearish trades in the lower half. This adds alignment to the setup.

How I Set Entries

When I plan an entry, I do not just chase a move. I wait for price to come to me. For bullish setups, I want to enter as close to support as possible. For bearish trades, I look to enter near resistance. Anchored VWAP adds another layer of confirmation. If price bounces at an anchored VWAP line, that gives me confidence to step in. I also look for volume confirmation or a clean reversal candle. If I see those, I know the level has weight.

The key is patience. I have learned from experience that rushing an entry almost always costs me money. Waiting for price to respect a level gives me better risk-to-reward and more confidence in the trade.

How I Set Exits

Exits matter just as much as entries. I set predefined profit targets based on seasonal averages or measured moves. If history shows the average seasonal move is 5 percent, that is my realistic expectation. I also set stop-losses beyond invalidation levels. For a bullish trade, that might be just under a recent swing low or beneath a VWAP break. For bearish trades, it might be just above resistance.

Sometimes I scale out of a position, taking partial profits at the first target and letting the rest run. Other times I exit all at once when the target is hit. If volatility expands, I may widen my stop slightly to give the trade room to work. But I never leave exits to chance.

Example

Recently, I took a seasonal trade on a stock with a 70 percent historical win rate in August. Price was in the upper half of its 12-week range, and anchored VWAP from the last earnings report was acting as support. I set my entry just above that VWAP line and got filled after a reversal candle confirmed the bounce. My target was a 4 percent move, consistent with the seasonal average, and my stop was set just under the swing low from two weeks prior. The stock reached my target within eight trading days, and the clear entry and exit plan kept me disciplined the whole way.

Key Rules

Never chase. If your entry level is missed, let it go and wait for the next setup.

Always define risk before entry. Know exactly where you will exit if you are wrong.

Let levels, not emotions, guide your decisions.

Final Word

Picking the right stock is only half the job. Knowing where to enter and where to exit is what makes the trade safe and profitable. Levels remove the guesswork and keep you disciplined under pressure. If you want to see how I apply this in real trades week after week, join my free Bootcamp where I share precise entry and exit levels with members in real time.